VLS Finance is a Delhi-based listed company which holds big chunks in some other listed companies like Relaxo Footwear, Ambika Cotton, Accelya Kale and many others, having a combined market value of Rs 950+ Cr. (as on 18th April 2016)

The market cap of VLS Finance, on the other hand is just Rs 150 Cr. which implies one is getting a dollar for 15 cents – a mouth-watering deal for any ‘Value Investor’?

Before we jump to any conclusion regarding the merit of this investment opportunity, let us have a look at how has the situation been historically and how has VLS’ marketcap moved with respect to the change in market value of its investments.

VLS doesn’t seem to have any major operational business of its own and primarily act only as an investment vehicle for its promoter, so the two primary reasons why VLS stock should do well are:

- Value of its investments go up.

- The discount to market value narrows down.

| Year | Market Value* of Investments (INR Cr.) | Market Cap – VLS Finance (INR Cr.) | Discount to Market Value (%) |

| 31-Mar-13 | 99.35 | 38.4 | -61.3% |

| 31-Mar-14 | 326.54 | 51.23 | -84.3% |

| 31-Mar-15 | 652.60 | 133.96 | -79.5% |

| 31-Mar-16 | 690.48 | 119.66 | -82.7% |

| 18-Apr-16 | 950.46 | 150.78 | -83.8% |

| Returns | 956% | 393% |

*Estimates based on public disclosures

In last three years, though the market value of investments have gone up over nine times, the market cap of VLS has increased only four times. So for somebody who invested in VLS for reason 1, it hasn’t played out well. It would have been far more profitable to buy underlying companies directly.

For those who bought it thinking the discount would narrow down and further add to profits, it has only got worse. The initial 60% discount which might have looked a good source of ‘Margin of Safety’ has now widened to 84%.

Whenever this opportunity was discussed in investor meetings or public forums, the majority including myself compared VLS to a holding company (Read Neeraj’s post on why it may not be worthwhile to invest in holding companies) which may not liquidate its holdings ever i.e. the value unlocking may not take place. A single investment, 1.6 Cr. shares in Relaxo constitutes ~87% of the total market value and these have been held since the IPO of Relaxo in early 1990’s. As an underwriter of an under-subscribed IPO VLS Finance was obligated to subscribe to the unsold portion, how fortunate of them, though they should be given the credit for holding on to it for over two decades. The argument by the other side has mostly been ‘VLS isn’t a holding company with strategic stakes, rather these are just financial investments and it is unjustified for it to trade at such steep discount to market value’

5th April 2016 – Big day for VLS

VLS finally unloaded a decent chunk of Relaxo; 1.7 mn shares totalling to Rs 75 Cr. to Westbridge Capital, probably would have been a 100-bagger since the IPO and this again brought VLS to lime-light and the stock was locked on 20% upper circuit.

Market probably got excited thinking 1). value-unlocking has finally started & 2). Rs 120 Cr. market cap company getting Rs 75 Cr. in cash implies a big deal. But as minority investor, the prime question to be answered is how would it benefit us?

- Can it reach us through dividends? VLS has never given dividends in its history. Promoters hold a 45% stake so may not look at dividend very positively, specially now when dividends are taxed thrice (when its earned, distributed and received).

- Buy-Back of shares? This could be another way of returning cash to shareholders and VLS infact did a tiny buy-back in 2014, can it do a meaningful one this time?

- If not, what will the management do with the cash? Invest/trade in other listed companies as VLS is purely an investment vehicle now for its promoters; the NBFC license has been surrendered and consulting business does not need any capital.

To me the probability of third is the highest making VLS not-so-attractive investment proposition from a minority’s perspective.

VLS could have been a very different story if:

- Management was open to passing on the dividends and occasionally the capital gains as special dividend/buy-backs.

- They had avoided capital mis-allocation in unrelated avenues like investment in 5-star Hotel in Delhi and massive trading in securities (Rs 4,600 Cr. in FY15)

There are a lot of defunct companies out there with valuable assets in the form of stakes in other companies, real estate, natural resources etc. But before we even think of investing in these opportunities we should have answers to three critical questions:

- Intention – Whether the current management is willing to monetize it?

- Action – What are the timelines for the said monetization; is it within next 12 months?

- Application – What will happen to the proceeds of such monetization; will minority shareholders benefit out of this?

The three should be asked in the same order and if answer to any of it is NO, may be one is better off skipping it rather than making a speculative bet.

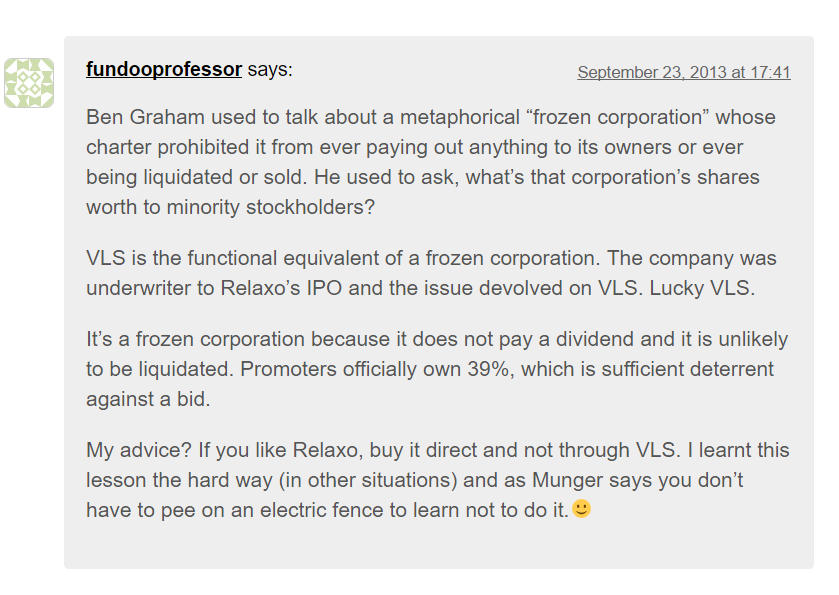

This is what Prof. Sanjay Bakshi had to say when somebody raised a similar query on VLS Finance on his blogpost ‘The Relaxo Lecture’

PS: In last two weeks, I have been asked to share my opinion on VLS at least three times, so thought it is better to write a short post 🙂

PPS: I generally do not invest in holding companies or asset-plays as these ideas lack longevity. However, I know people who have made a lot of money by investing in such opportunities and VLS could well be one of the those, so do your own home work 🙂 I do not claim that my views are right and others’ are wrong, do share your views in the comments section below.

PPPS: We have revamped our website and added interesting features like free signup where guest users too can access some select research reports so do checkout – https://stalwartvalue.com/

Disclaimer: Stalwart Advisors (herein referred to as SA) including its directors, employees and their relatives do not have any financial interest in the subject company. Please read the complete disclaimer here

Leave a Reply