Model Portfolio vs Customized Portfolio

In the investing world, there are two schools of thought – one which believes there are only two states for a stock – Buy or Sell, while the other believes there is also an interim state called Hold.

The logic behind the former is that when you hold a stock it implies you see sufficient upside in it so as to retain it in your portfolio (& not exit). Then why is it not worthy of being a ‘buy/add’ at current market price? In other words, if you were starting afresh with cash, and you would not buy this stock at current price, then should you even hold it?. In a way, you buy your book every day.

The other school says there is an interim state – Hold. In this state, you don’t want to buy/add a stock, but not sell it either. You just want to hold it at current price.

For a PMS which manages money in individual accounts, the above choice has serious consequences on how it manages money for its clients as well as the outcomes for its clients.

Category I – Buy or Sell

If PMS goes the former route, it is essentially following a Model Portfolio approach. Let’s say there are 20 businesses (stocks) selected by the fund manager at inception and bought in initial client accounts. As years pass, the same stocks will continue to be bought in the same proportion with all fresh fund inflows i.e. for new clients as well as additional funds put in by old clients. Some of these stocks may have risen substantially by 50-100-200% but as long as they are not sold from initial accounts, these continue to get added in latest accounts, irrespective of their individual valuation, in order to maintain mirrored portfolios.

Following such an approach makes the life of PMS/Fund Manager simpler & easier as:

- There is NO customization done for individual client accounts.

- There is NO idle cash left in any account as 100% of the funds get deployed on day 1 as per the Model Portfolio.

- All accounts have exactly the same holdings (stocks) at all points in time.

- This deployment strategy is 100% similar to a Mutual Fund / Index Fund / Exchange Traded Fund wherein investors get new units allotted based on that day’s NAV.

- The timing decision of the investment i.e. whether it is a good time to invest/add funds completely rests with the investor – the fund manager will simply deploy it all as soon as the client transfer the funds.

Category II – Buy or Hold or Sell

A PMS that also has a ‘hold’ rating for its portfolio stocks will chose NOT to buy the hold-rated stocks with fresh inflows. Continuing the above example of 20 stock portfolio, assume the fund manager has 8 stocks rated as hold. Then only the remaining 12 stocks will be bought with fresh inflows implying the remaining stay as cash waiting for better entry points.

Depending upon market volatility, the hold-rated stocks could go through price correction (stock price falls) or time correction (stock price stays flat but earnings catch up contracting the valuation) which is when these could be bought/added again. The other possibility could be that the hold-rated stocks continue to rise and are exited from older accounts making room for newer opportunities to be bought in all the accounts including the newer ones.

Following such an approach makes the life of PMS/Fund Manager complex & difficult as:

- Each account managed by PMS is fully customised in terms of deployment.

- Due to hold-rated stocks, there will be some idle cash earning 5-6% (Liquid MF) and waiting to be deployed in equities.

- All portfolio accounts are not a mirror image of each other at all points in time, specially the newer ones could be substantially different from older ones. It takes a while before new accounts get aligned to older ones.

- The timing decision of the investment i.e. whether it is a good time to deploy completely rests with the Fund Manager – investor can open the account and/or continue to add funds whenever available. The fund manager will continue to monitor valuations and whole host of other factors to customise deployment and remove the timing worry from client’s mind.

At Stalwart, since the very inception, we were clear that we will follow the latter – we customise deployment as opposed to following a Model Portfolio. We believe having a hold rating for our stocks is absolutely logical and rational.

When we are evaluating a listed company (stock), first it has to meet most of our growth, quality & hygiene filters on business & management parameters. After that, we try to arrive at an intrinsic value (fair value) of the business today and its potential value 3-5 years from now.

This exercise involves a lot of assumptions which are prone to errors. Hence, instead of arriving at an absolute number upto two decimal points via excel spreadsheet/discounted cash flow analysis, we try to calculate a broad range. It is better to be roughly right than being precisely wrong. This gives an idea of the potential upside – the reward.

The next crucial step is to assess the downside – how much do we stand to lose if our investment thesis fails – the risk.

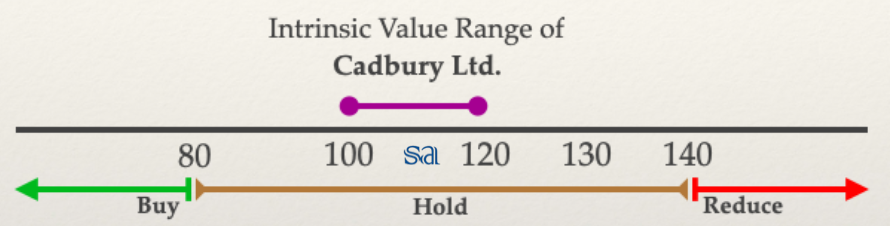

As an illustration, consider the following hypothetical case of Cadbury Limited:

Our assessment of the intrinsic value for Cadbury Ltd. is Rs 100 – 120 per share. The buy price has to be 20-30% lower to build in some margin of safety implying we prefer to buy at Rs 80 or lower. Once stock rises and the discount disappears, it enters the hold range between Rs 80 to Rs 140, during which it is neither a buy for us, but nor a sell yet. Once it crosses Rs 140, we tend to begin reducing the allocation, assuming our initial assessment has stayed the same.

| Stock Price | Risk (Downside to 60) | Reward (Upside to 140) | Risk-Reward Ratio |

| 70 | 15% | 100% | 1 : 6 |

| 100 | 40% | 40% | 1 : 1 |

| 130 | 54% | 7.7% | 1 : 0.1 |

Buying the same stock at Rs 70 versus 130 has substantial difference in margin of safety and risk-reward – while it had a great risk-reward at Rs 70 for clients at that time, it could be a terrible buy for newer clients at Rs 130, even though the same stock is being held in older accounts.

There are four possible combinations from risk-reward assessment:

| Basket | Risk | Reward | Illustrative Examples | For Stalwart PMS |

| 1 | High | High | Suven Life (Innovator) | Avoid |

| 2 | High | Low | Unsecured Lending (Micro Finance / Credit Cards) | Avoid |

| 3 | Low | High | Suven Pharma (CDMO) & Usha Martin | Core Bets (Asymmetric Payoffs) |

| 4 | Low | Low | Large Cap IT (TCS) / Bank (HDFC Bank) | Remainder (Compounders) |

We want to avoid stocks where downside risk is high, so 1st & 2nd baskets are mostly ruled out from our universe of investable opportunities.

From the remaining, the most attractive opportunities are present in the 3rd basket – low risk but high reward. Attractive businesses bought at low valuation due to variant perception / special situation / past mistakes of capital allocation etc. fall in this basket – Gujarat Ambuja Exports (2017, 5x), Suven Pharma (2019, 7x), Usha Martin (2021, 7x) are some such examples from our portfolio.

Usha Martin: Buy/Hold + Intrinsic Value

We started buying Usha Martin at Rs 57 a share in July 2021, with initial assessment of its intrinsic value range to be Rs 180 – 220 per share. This implied that the upside potential was ~300% while downside seemed much lower at ~20%. The risk-reward ratio was hence attractive at 1:15.

To maintain a margin of safety, we prefer to buy at 20-30% discount to our estimated intrinsic value which implied we could continue to buy this stock upto Rs 150 giving a big enough buying range versus then prevailing price of Rs 57.

An important point to note is that intrinsic value isn’t static rather it gets updated periodically; as the business grows its scale & quality – reported revenues & profitability, growth trajectory (led by upcoming capacities), return ratios, balance sheet quality, capital allocation etc.

| Usha Martin’s | Stock Price (Rs) | Intrinsic Value Range (Rs) | Buy Limit (Rs) | Rating | Trailing Annual Net Profit (Rs Cr) |

| July 2021 | 57 | 180 – 220 | Upto 150 | Buy | 152 |

| April 2022 | 160 | 180 – 220 | Upto 150 | Hold | 291 |

| July 2023 | 290 | 350 – 400 | Upto 300 | Buy | 351 |

| October 2024 | 400 | 500 – 550 | Upto 375 | Hold | 424 |

As shown in the table above – we bought Usha Martin from Rs 57 a share, all the way up to Rs 300 with current buy limit again revised upwards to Rs 375. This was well supported by a rising intrinsic value led by increasing annual net profit from Rs 152 Cr to Rs 424 Cr as well as quality of balance sheet – RoCE going above 20%, complete deleveraging, improving capital allocation etc. Hence, even at Rs 375 we believe it offers a favourable risk-reward ratio for incremental additions to portfolio.

In between, whenever stock moved beyond the buying limit, we put the stock on hold and stopped adding. Market by nature is a volatile animal, and more often than not, stocks do go through price and/or time correction giving opportunities to buy/add again.

The customization often leads to idle cash which raises following assertions/questions:

- Clients put money in an equity fund to get exposure to equities and not liquid fund.

- If funds have to be parked in a liquid fund, why should clients pay any fee in this period?

- Clients have already done asset allocation at their end, and this part of their net-worth is supposed to be immediately invested in equity. If the market falls, they can always rebalance i.e. move funds from other asset classes to equity to average down.

- Isn’t sitting on cash trying to time the market, which is speculative & almost impossible?

- Isn’t the fund manager taking unnecessary risk by sitting on cash, while the fund’s equity benchmark could continue moving up leading to underperformance / negative PR / poor rating by the media?

While the above assertions are valid, in our case cash is incidental rather than intentional. We DON’T randomly hold 25% cash thinking Nifty PE is above 22 or the upcoming US Elections result is uncertain, so let us wait for ‘markets’ to fall. That’s indeed nothing but a speculative behaviour.

Rather, we are purely bottom-up stock pickers and we keep on deploying as long as we find valuation comfort (favourable risk-reward) in our universe of companies (that meet our checklist on business quality & management hygiene).

When that stops, we allocate more to compounders (Basket 4 in the table above), and the remaining, if any, gets parked in Liquid Fund (earning 5-6%) waiting for better opportunities.

Sitting on idle cash could hurt clients when a PMS charges a high fixed (management) fee of 2-2.50% per annum (standard for most PMS in India). However, at Stalwart, the fixed fee is negligible at 0.50%, as we have aligned our interest with investors via performance fee – we earn only when portfolio delivers good incremental returns above the hurdle rate of 7% (compounded annually on initial investment).

Further, for larger accounts (> Rs 2 Cr), we park idle funds in our fixed income scheme – Stalwart Liquid STP, where the fee is zero (no management/performance fee).

We don’t worry about benchmark comparison (as explained on Page 3) and are prepared to underperform periodically. In this era of smartphone & internet, there is NO information edge and NO analytical edge as all the investors have access to the same information & analysis. Hence, the only edge remaining to outperform the markets in the long-run is the behavioural edge – the ability to sit out when we can’t find sensible ideas that fit our process, the ability to manage FOMO and avoid things outside our circle of competence, the ability to manage envy when other market participants are being rewarded for recklessness & most importantly the ability to focus more on the risks over potential reward.

We want to continue doing what we believe is good for our investors in the long-run even if it is complex & difficult, rather than doing what is simple & easy and is perceived to be the standard in the fund management industry.

This is an excerpt from PMS Partners’ Memo (Oct 2024)

Leave a Reply