| Serial No. | Nature of Fees | Annual Fees |

|---|---|---|

| 1. | Management (Fixed) Fee (on average assets under management) | 0.50% |

| 2. | Performance Fee (on returns above 7%) | 20% |

| 3. | Other Incidental Charges: Brokerage, Custodian Fee, GST etc. | At Actual |

| 4. | Exit Load / Lock in | Nil |

- The fee charged by Stalwart Investment Advisors comes with a certain underlying philosophy – we deserve to earn only once our partners have earned.

- Keeping this in mind, the fixed fee is kept at a nominal 0.50% of funds per annum, just to cover the account management costs. The comparable fixed fee in other PMSs & Mutual Funds is 1-2%.

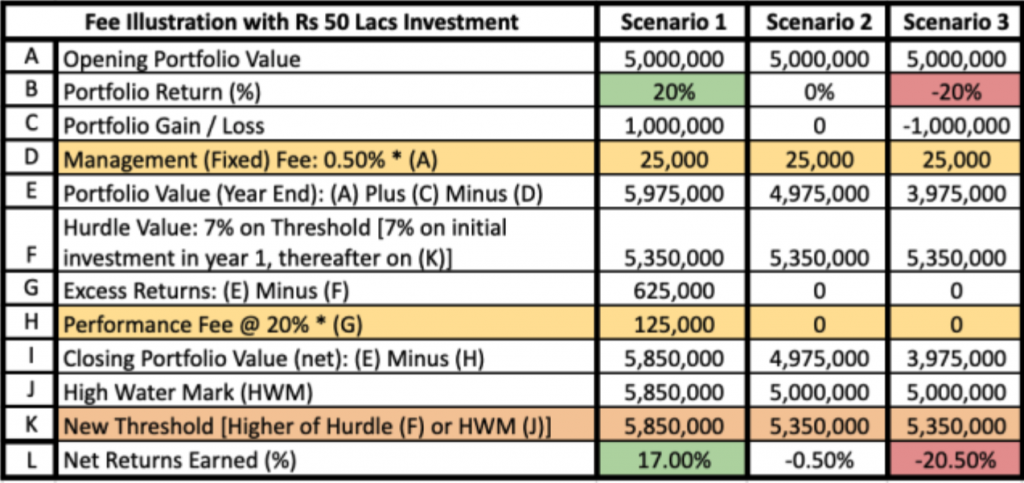

- Only when annual returns are above the hurdle rate of 7%, a performance fee of 20% on excess returns (above 7%) would accrue.

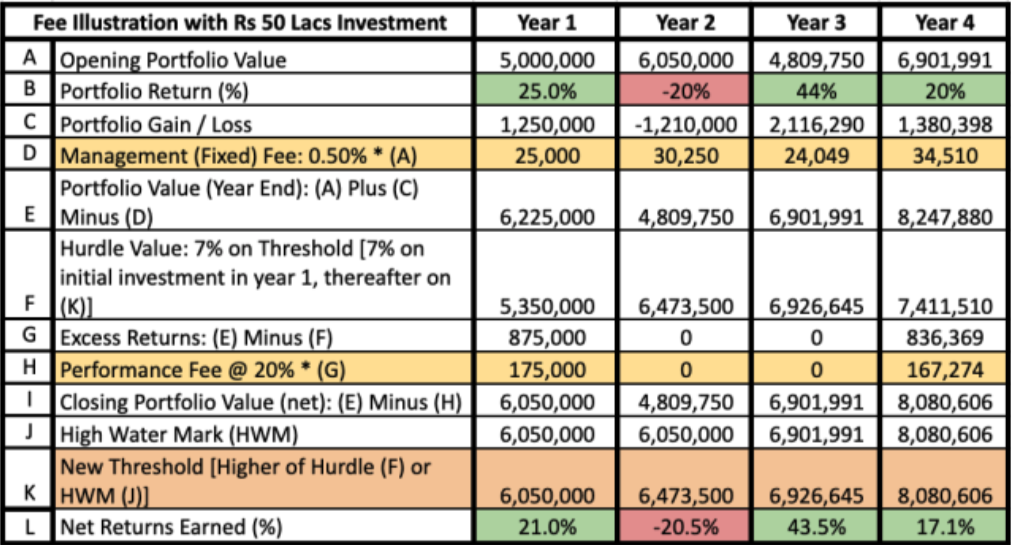

- While calculating performance fees, we follow the two best practices keeping in mind the interest of our partners: Compounding hurdle on the initial capital (beneficial to investors in flat/down years), while jumping to the higher of the hurdle or high-water mark for subsequent threshold (beneficial to investors in years with large gains).

Fee Illustration – Single Year

Fee Illustration – Multi Year

Fee Illustration – Terminology

Hurdle Rate is the minimum return a portfolio should generate before any performance fee can kick in. When the return is 10% and the hurdle rate is 7%, the fee would be calculated on excess returns of 3%. We follow ‘hurdle rate compounding‘ on the initial investment even in down/flat years which is a fair practice in the interest of our partners (investors). The threshold for performance fee jumps to the higher of hurdle or high-water mark in subsequent years.

High water mark (HWM) is the highest value of the portfolio ever achieved. To deserve a performance fee, the portfolio should be above the hurdle rate as well as HWM. For instance, portfolio value goes up from Rs 100 to Rs 130 (after all fee & expenses). In the second year, the value drops to Rs 120 and in the third year it again goes back to Rs 130, there will be no performance fee as the fund is still not above its prior highs of Rs 130 (HWM). This protects investors from paying performance fees twice on the same gains.

Moreover, the hurdle for performance fee also shifts to Rs 130 at the end of 1st year. The hurdle compounding of 7% for second & third year implies the new threshold for performance fee will be Rs 149 (130 *1.07 * 1.07) for 3rd year.

For simplicity, we have not accounted other expenses like brokerage (0.10%), STT (0.10%), custodian & fund accounting fee (0.04%), etc. which all put together work out to be about 0.20-0.25% of fund value per annum. All expenses attract 18% GST, registered entities can avail input credit (if eligible).

Important: We prefer simplicity and transparency, hence we have only one fee model as explained above. This is uniformly applied to all our partner accounts irrespective of size or vintage. While we offer customized service to all our partners, the fee terms are standardized and non-negotiable.