Disclaimer: We are totally into bottom-up stock-picking and are amateurs when it comes to making sense out of Macros. This post is just a small attempt to share our thought process regarding current market environment and some interesting observations 🙂 Imagine a conversation between two investors regarding a hot mid-cap which has recently done pretty well. The optimist might justify buying or holding on to it saying ‘Boss look at this new CEO who seems like an intelligent fanatic, has fire-in-the-belly to make it a global giant, look at his execution quality over last three years and the earnings potential of this business given humungous size of the market opportunity’ The cautious investor however would differ by pointing out to current valuations being close to life-time high and the potential irrational moves by competitors in the short-term.  Today, India’s global position is very similar to that mid-cap company which is trading at rich valuations however undergoing some structural changes having potential to change its very orbit. The interesting part is that arguments from both sides are so strong and sensible, that you get swayed in that direction depending on whether you are talking more to bears or bulls. It is now widely acknowledged that India’s current leadership is strongest we have ever had. We are witnessing some landmark reforms like GST (See video: India’s Consolidation Wave), promoting intiatives like Make-in-India to give impetus to manufacturing and boost employment generation, Financial Inclusion, Direct Benefit Transfer and Crop Insurance to remove leakages and empower rural India, Real Estate Regulator Bill, significant focus on improving ease of doing business with lots of small incremental improvements leveraging technology, meaningful efforts to curb black economy, focus on building infrastructure across the board be it roads, railways, power etc. In short there have been many right moves and we seem to be heading in the right direction. We are today the fastest growing major economy in the world, commodity crash has been a major boon for us helping manage our current account deficit, making our currency one of the strongest among Emerging markets, helping control inflation and making room for interest rate cuts.

Today, India’s global position is very similar to that mid-cap company which is trading at rich valuations however undergoing some structural changes having potential to change its very orbit. The interesting part is that arguments from both sides are so strong and sensible, that you get swayed in that direction depending on whether you are talking more to bears or bulls. It is now widely acknowledged that India’s current leadership is strongest we have ever had. We are witnessing some landmark reforms like GST (See video: India’s Consolidation Wave), promoting intiatives like Make-in-India to give impetus to manufacturing and boost employment generation, Financial Inclusion, Direct Benefit Transfer and Crop Insurance to remove leakages and empower rural India, Real Estate Regulator Bill, significant focus on improving ease of doing business with lots of small incremental improvements leveraging technology, meaningful efforts to curb black economy, focus on building infrastructure across the board be it roads, railways, power etc. In short there have been many right moves and we seem to be heading in the right direction. We are today the fastest growing major economy in the world, commodity crash has been a major boon for us helping manage our current account deficit, making our currency one of the strongest among Emerging markets, helping control inflation and making room for interest rate cuts.

The eminent question- Is it all priced in? May be, may be not!

This bull market started towards the end of 2013, months before the new central Government was elected. If one goes by the index returns it is nothing much to talk about – Nifty has moved up barely 40% in these three years (Oct’13-Oct’16) and we calling it a bull market? Tell it to someone who witnessed 1991 bull market and he might think you are kidding! That’s because this time the action has been entirely in the broader markets: Here’s a snapshot of how stocks have fared in last three years:

| Returns | No. of Stocks |

| >1000% | 70 |

| 500-1000% | 181 |

| 300-500% | 237 |

| 200-300% | 225 |

| 100-200% | 368 |

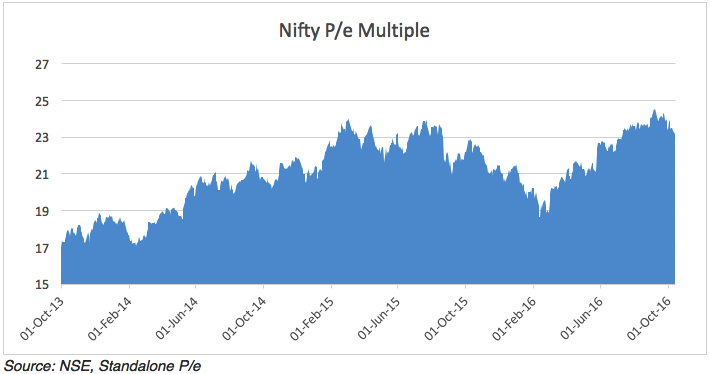

Source: Ace Equity, Companies traded on BSE. However, a significant part of this return has come by way of re-rating i.e. multiple expansion. Today, Investors are willing to pay much more for every rupee earned by a company versus what they were willing to pay in 2013. A lot of companies which were trading in 10-20 P/e band have been re-rated to 40-50-60 P/e bands. For a lot of companies, specially constituents of key indices, the earnings growth has significantly lagged expectations and is yet to catch up, resulting in Nifty’s average P/e spiking to 23.  This is even worse for small and mid cap indices, where P/e multiples are even higher than Nifty Fifty’s. We all understand what happens when we pay too much for even something that is good- we end up either loosing capital or suffer opportunity cost due to time correction; for earnings to catch-up. Here’s a snapshot of 3, 5 and 7 year returns of Nifty based on entry P/e of Nifty:

This is even worse for small and mid cap indices, where P/e multiples are even higher than Nifty Fifty’s. We all understand what happens when we pay too much for even something that is good- we end up either loosing capital or suffer opportunity cost due to time correction; for earnings to catch-up. Here’s a snapshot of 3, 5 and 7 year returns of Nifty based on entry P/e of Nifty:

| P/e* | 3 years | 5 years | 7 years |

| less than 14 | 31% | 24% | 19% |

| 14-18 | 21% | 22% | 18% |

| 18-22 | 9% | 9% | 13% |

| above 22 | -1% | 6% | 12% |

*Standalone. Source: NSE If you invest in markets when P/e is lower than 14, the returns over next few years are phenomenal, however that needs a lot of patience and ability to sit on cash. There have been only 415 trading days in last 4,435 days, when Nifty traded at a P/e below 14 i.e. just one out of ten days. However, if you are entering on the other extreme, the only saving grace could be a long-term investment horizon.

But this time its different! (Yes we know that’s the most abused phrase in markets)

In 2007 not only the P/e reached its peak at 28, but the profit margins, average capacity utilization, market capitalization to GDP ratio etc. were all very high. However, based on FY16 data, the situation is much different than previous bull market; there is significant room for earnings to catch up given the low capacity utilization and potential margin expansion, which are much below long term average. (Read a detailed analysis by Mr. Samit of SageOne in his Investor Memo) We are already seeing some early signs of domestic capex revival. A good monsoon after two consecutive draughts is further expected to revive rural economy which should have a ripple effect on lot of sectors.

Our take on Indian Markets

- We feel markets have become challenging for value investors and incrementally getting difficult to find attractive opportunities.

- We are not implying sell everything and run away, however risk-reward isn’t that favorable. Markets can double even from these levels too, who knows? But these are times when more importance should be given to Return ‘of’ Capital Vs. Return ‘on’ Capital.

- We have raised some cash in the portfolio and are looking at sectors which are out of favor and haven’t participated in this bull market like capital goods, engineering companies, real estate etc., however without compromising on the process.

Are you holding Bubble-portfolio?

Another important consideration is the composition of portfolio during such heated markets. If somebody had majority of the portfolio in TMT (Technology, Media and Telecom) stocks during the 2000 bubble, the portfolio would have not only crashed 80-90% but majority stocks never recovered leading to permanent loss of capital. Similarly, during 2007-08, if the portfolio held majority stocks from infrastructure and capital goods same story would have repeated. This time around, there is no specific sector that is leading the bull market, however one can clearly see bubble valuation in select pockets.

What about the Global Risk?

Not just Governments but even corporates have started issuing negative yield bonds and easily finding takers. French pharmaceutical firm Sanofi & German consumer goods producer Henkel recently issued bonds worth Euro 1bn and Euro 500mn at yields of -0.05% respectively. This is an unchartered territory and nobody seems to have an answer on how its going to end. Today there are about $14.5 trillion worth of bonds globally that are trading at negative yield. The money is free for anyone to borrow; in fact, you are paid to borrow. This has created huge liquidity which has found its way to other asset classes, mainly equities. Will it correct soon or become the new normal? We would have to wait to get answers. All this Macro Analysis is fine.. But end of the day what’s most important is your portfolio composition- Are you comfortable with your portfolio companies? If you are selling some positions or adding new cash, are you able to spot opportunities that meet your hurdle rate without compromising on your investment process? Ultimately its these factors that should drive your decision making.

Some Interesting & Funny Observations

- There is a new breed of investors who are probably experiencing their first bull market and can be seen on social media and WhatsApp Groups. There is a lot of exuberance and investing is starting to look like easy money.

- Quality of ideas discussed in forums are deteriorating – holding companies, asset plays, chore bane more are the emerging themes.

- Google Trends show ‘multibagger’ search making new highs, as much as 3x from 2007 peak.

- Getting calls from friends and family however funny part is that calls are either of these two extremes:

- Some are those who invested at previous peak (2007) in ULIPs, they have finally broken even and seeking suggestion if they should exit.

- Others are first time investors and want to know next multi-bagger stock idea or best ‘small & mid cap’ fund.

- New experts are emerging on social media platforms like Twitter. These ‘Gurus’ regularly tweet about their stocks (after they buy) but these are merely tips as they don’t carry investment thesis and risks involved-

‘I am looking at ‘Suckers Limited’, seems interesting. After a long consolidation the stock seems to be at an inflection point’

is all you can say when you are allowed maximum of 140 characters. Remember the words of wisdom by Rakesh Jhunjhunwala ‘Tips are hazardous to wealth’.

We also share some of our preferred picks, however every idea which we have shared in public domain over last two years have been accompanied with research reports carrying detailed investment thesis and major risk factors involved, which is followed up by regular updates along with current rating to all our guest users too. (Sign up for free and see for yourself- investor.stalwartvalue.com)

Are you a new investor? Here’s our advice for you

- Avoid investing it all at once- this may not be the best time to commit big money. Invest some portion in few good businesses, for rest wait for a better opportunity; they always come – remember Feb-Mar’16.

- Worst time to go down the quality curve– stick to well run businesses and managements with unquestionable integrity. Since quality businesses are trading at 40-50 P/e, others at 20 P/e might look relatively cheap but what if latter deserves a 5 P/e given the track record of its promoters?

- Avoid tips at all cost and stay away from noise- if you don’t have time to do in-depth research, outsource it to fund managers via SIP or trusted advisories, but don’t risk your capital for tiny gains.

- Have minimum horizon of five years, longer the better.

- Control greed and have a reasonable expectation– attempting to make quick buck would make you prone to commit grave mistakes.

How can we help you?

Stalwart Advisors is a SEBI registered advisor, run by a team of full-time investors with skin-in-the-game and vast experience in securities analysis and portfolio management. You can see our preferred picks and model portfolio by subscribing to our advisory plans, it’s entirely online and on-boarding takes less than two minutes.

Leave a Reply