‘Market has risen too much too soon, a crash can come anytime. I have started selling’

‘I am raising 20% cash (i.e. selling 20% of my portfolio in one shot) as the market seems heated’

‘Valuation seems too expensive so I will not enter the market now & will wait for a correction’

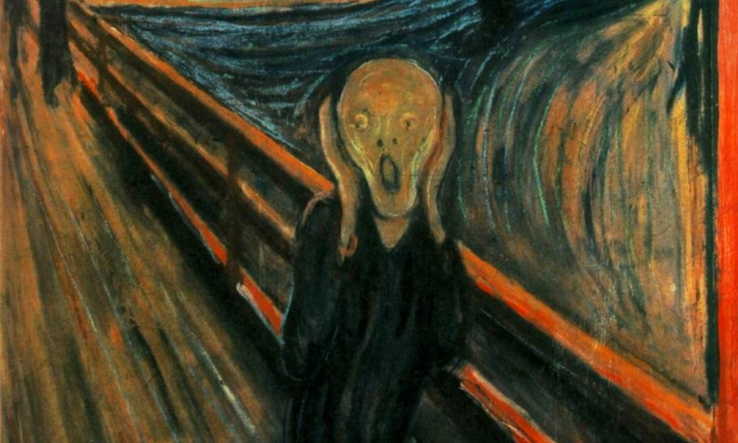

These are some of the common statements I have heard from different individuals I have interacted over the last few days. Each has their risk appetite & their unique way of dealing with it, but hearing these things triggered certain thoughts in my mind and hence this post.

After an extra-ordinary year where all portfolios have done so well, it is natural to have some anxiety as we enter 2024. I am making an attempt to synthesise our thought process on how we are approaching it.

—

Indian market is at a lifetime high and accordingly, valuation too has risen – we are at 23 times Price to Earning (PE) currently for Nifty (an index of 50 of India’s largest traded companies).

In the long-term, Nifty has mostly traded between 15-25 PE, implying we are currently in the higher band of this range.

Naturally, the number of experts voicing caution has multiplied. Pessimistic/negative views anyway get more attention + engagement, versus usual positive/boring discourse around not disrupting the long-term compounding.

There is indeed an exuberance in the equity market reflecting in hyperactivity in SMEs, the IPO market, and late-to-party segments like PSUs, holding companies & chor-bane-mor (lacking corporate governance). At this juncture, even the eternal bulls might tone down their bullish opinion on India’s relative strength & long-term prospects, to avoid adding fuel to fire / speculative activities.

So net-net, at these euphoric times, one would hear a cheer from momentum players/traders, but for long-term investing, caution takes over optimism.

It is wise to stay cautious, but for those who are new to markets or in their 1st/2nd market cycle, this induced fear makes them avoid putting any new money at work and also constantly consider selling existing holdings having recently generated high returns (to raise cash in anticipation of a market crash).

The issue is valuation remains an art and not a science/math problem. It is not black or white. If 15 PE meant buying & 25 PE meant selling, even an algorithm would have done the job. In reality, it doesn’t work like that as the denominator (earnings) isn’t stable.

What makes it tricky is that while the factual/reported PE is based on last year’s earnings (which may or may not be normalized), the value over the next 5-10 years would be created by stability & multiplication of the earnings. All else equal, a lower entry PE would surely lead to a higher margin of safety & better returns, but it is still the earnings growth that will drive the majority of the value creation/returns in the long run (5 years & longer).

India Inc. had a massive earnings growth in the 2003-08 economic boom which got punctured by the global financial crisis. 2014 marked a regime change for our country with the NDA government unleashing a series of transformative policies – Demonetization, Banking’s NPA clean up + Insolvency and bankruptcy code, RERA, GST, Lower corporate taxes + PLI sops for new manufacturing setups, and so on & so forth. Policies that are intended to create a huge positive impact in the long run often first slow down things in the short run. Hence, the earnings growth over the last decade has been tepid at a high single digit. The transformation has begun to show its results & if the earnings growth rate were to go back to 10-14% CAGR in this economic cycle, the equation could completely change.

Further, one can use Nifty PE as a reference for market valuation, but it is important to remember that this is the weighted average of the 50 largest companies in the index. Averages tend to hide the extremes – within the index, on one extreme we have an HDFC Bank trading at a PE of 18, which is one of the lowest in its history despite no deterioration in fundamentals, and on the other extreme there is Titan & Nestle with their PE at 90-100.

Nifty PE is more relevant for those invested in Index or Large-cap Mutual Funds, however for bottom-up stock pickers, what matters more is the valuation of their portfolio, which could be starkly different than the index (higher/lower) adjusted for the quality of earnings & growth profile versus the Index, to determine premium/discount over Index PE.

When it comes to the valuation of individual companies, the key is to judge the 1). stability & quality of earnings and 2). the growth potential. The former comes via an understanding of the business model (economic moat) whereas the latter via the size of the market opportunity & promoter hunger.

FMCG and IT get high valuations despite having low growth (5-10%) because earnings are fairly predictable and high quality (high RoE, debt-free, free cash). Probably, this is why these have generally been a good store of value (defensives) despite unimpressive growth.

Otherwise, above-average earnings growth (>15% CAGR) is the most important ingredient for a decent long-term return. A 25-PE stock with 18% CAGR in earnings is likely to do better than a 15-PE stock with no growth. So earnings growth takes precedence over valuation.

Magic happens when a stable set of earnings, enter a high growth trajectory, think DMart. Its 2017 IPO at Rs 290/share was seemingly at a high PE and yet the stock is at Rs 4,000 today, as the net profit itself has multiplied five times to Rs 2,300 Cr. while the PE has re-rated further. Even if PE had not re-rated at all or de-rated a little, it would have still been an impressive outcome for shareholders, due to the sheer multiplication of earnings.

For businesses that don’t enjoy stable & predictable earnings, which is the case with over 90% of the listed businesses, PE is not even the right metric to value them. Most businesses are commodity (replicable with a cheque) and ideally, they should not trade beyond their replacement cost (implied low PE). As better quality businesses (commanding higher PE) from FMCG/IT/BFSI have occupied larger weights in Nifty, the weighted average PE has also risen making it further difficult to compare its PE with historical data.

Just to clarify, I am not encouraging BAAP (buy-at-any-price) philosophy, far from it. Entry valuation is extremely important and perhaps the only variable we control while buying/selling stocks. However, this requires a nuanced approach and PE is only a shortcut. Add to that, referring to the PE of an index with little overlap with a bottom-up portfolio to make buy/hold/sell decisions may not be justified.

Do note that if Nifty were to undergo a 10-20% correction, which can happen anytime for any reason irrespective of valuation, even a bottom-up portfolio would face a drawdown, probably a higher drawdown. This cannot be avoided by investors focussed on long-term compounding, however, it is important to note that for well-constructed portfolios, this is merely a temporary drawdown. Our focus is to avoid permanent loss of capital which happens via faulty selection of business/management or excessively overpaying (losing valuation discipline).

Valuation is an extremely tricky topic, so I am sorry if I have confused you. It is not 2+2=4, but an art that is subjective & difficult to explain. My key point is that just because index PE is some XX, one blindly avoiding investing at all or selling all existing holdings in a bottom-up portfolio may not be rational.

However, if we sell an existing portfolio stock (for whatever reason) and are not able to find another deployable opportunity that meets our investment criteria while being available at a reasonable valuation, it is justified to sit on cash until those opportunities present themselves.

The above scenario does not amount to taking a cash call. A cash call is when one perceives the market valuation to be high or going through a euphoria and decides to exit equities fully or raise 30-40-50% cash by selling all holdings proportionately, irrespective of how those individual businesses are placed in terms of earnings growth trajectory/valuations. So cash call is a top-down call, rather than a bottom-up one.

Moreover, cash call tends to work only at scale with extreme outcomes – a hero or zero. Hero, if markets indeed crash and one gets to re-enter at far lower levels & zero if markets continue to climb up leading to major opportunity cost. It works at scale because selling merely a 20% portfolio and re-entering at a 25% fall only adds a one-time 5% return to the overall portfolio, that too when done with perfection – sold at the top & bought at the bottom, which rarely happens in reality. If one were to consider the leakages in this process i.e. taxes, brokerage, impact cost, etc., the final result is likely to make the entire exercise meaningless, barring the psychological comfort of holding cash during a market crash.

How are we managing risk & fresh deployment at Stalwart?

We are not benchmarked or glued to any specific index, rather we practice bottom-up stock picking. This allows us to manage risks at such times by avoiding the frothy pockets – IPO / SME / Micro Caps / Order book driven hype / most PSUs / Consumer, etc.

For fresh capital or additional capital (by existing partners), the deployment strategy is as follows:

1. We continue to deploy, albeit much lower (currently down to 40-50%), in our core small- & mid-caps that meet our investment & valuation criteria.

2. The next leg goes into safe havens & steady compounders (currently at 20-30%); these are relatively larger names from BFSI, Pharma & certain niche opportunities where there is valuation comfort. This is preferable to us over holding cash, to the extent possible without diluting investment criteria.

3. After deploying in available opportunities in both the core basket and steady compounders basket, whatever cash is left is by default held as cash waiting for better opportunities – we don’t have any compulsion to be fully invested and each portfolio we construct is fully customized.

We believe this is the key advantage of having a multi-cap & sector-agnostic mandate, as opposed to schemes (funds) that can only invest in small-caps or specific sectors like IT or Healthcare or can’t sit on cash, because they are forced to continue doing the same (by mandate) even when it ceases to make any sense (late cycle).

—

If you have any thoughts/queries about this post, please leave it in the comments below or hit my inbox.

Wishing everyone a Happy 2024 & peaceful compounding for many years ahead!

Regards,

Jatin Khemani, CFA

CIO, Stalwart Investment Advisors LLP (PMS | Research)

jatin@stalwartvalue.com

Annexure: Understanding PE & its follies

In 2015 I wrote a post on a related topic, titled ‘Obsession with PE multiple’ covering three ways most of us use it wrongly: https://stalwartvalue.com/obsession-with-pe-multiple/

Leave a Reply